Bitcoin ETFs Still Attracting Billions, and July Could Be a Turning Point

The crypto industry never stands still. And the latest developments around Bitcoin ETFs prove that once again. Since their launch in January, these investment products have attracted a veritable flood of investments. With a total inflow of $14.65 billion, it seems that investors have flocked to this new way of investing in Bitcoin.

Top day for Bitcoin ETFs

Last Monday was a particularly good day for Bitcoin ETFs. There flowed as much as $129.45 million in, the highest amount since June 7. Fidelity’s FBTC was the big winner with $65 million in new investments. Bitwise’s BITB followed closely with $41 million. Other providers such as Ark Invest, 21Shares, Invesco and VanEck also saw positive inflows, albeit in smaller amounts.

Big players on the sidelines

Interestingly, the two largest players in the market, BlackRock’s IBIT and Grayscale’s GBTC, remained on the sidelines this time around. This shows that the Bitcoin ETF market is still very much in flux and that the balance between the different providers can shift.

Mixed picture for digital assets

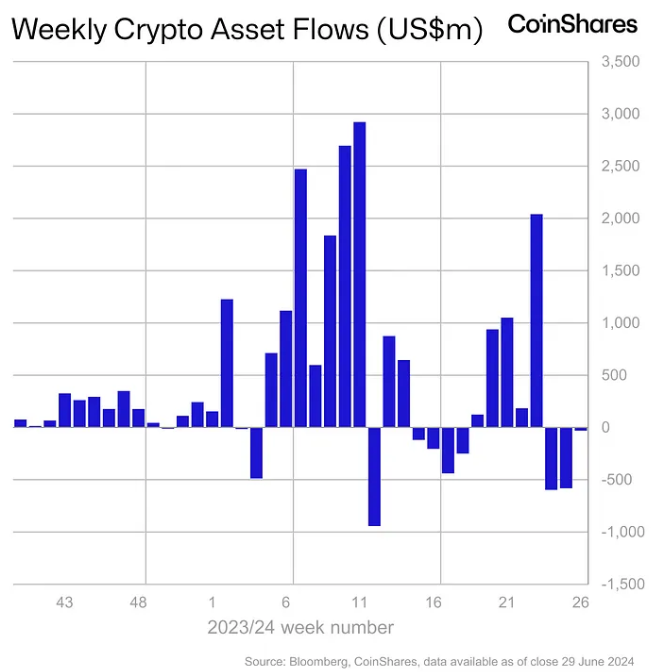

While Bitcoin ETFs are booming, digital asset investment products as a whole are showing a mixed picture. Outflows were seen for the third week in a row, albeit less severe than in previous weeks. Grayscale saw a hefty outflow of $153 million, raising questions about the future of their product.

Geographical shifts

There are also interesting shifts geographically. The United States, Brazil and Australia attracted investment, while countries such as Germany, Hong Kong, Canada and Switzerland saw money flow out. This could indicate a shift in global sentiment around cryptocurrencies.

Ethereum under pressure

Ethereum, the second largest cryptocurrency, has been hit hard. With the largest outflow Since August 2022, the network has lost $61 million in investments in the past week, making Ethereum the worst-performing digital asset in terms of net flows this year.

Optimism for July

Despite these mixed results, analysts are optimistic about Bitcoin and Ethereum’s performance in July. Historically, these digital assets tend to perform strongly in this month, especially after a negative June. The potential launch of an Ethereum spot ETF could also contribute to a positive mood in the market.

What does this mean for investors?

For investors, it is important to keep a close eye on these developments. The growing popularity of Bitcoin ETFs, combined with shifts in the broader digital asset market, could present new opportunities. At the same time, outflows from some products indicate that caution remains warranted.