Weekend column: Where does all the selling pressure come from?

Goodday everyone,

The price is falling, bears are screaming their lungs out. But the trick is to stay calm point by point.

and a bit of data analysis. Who’s selling?

Where does the selling pressure come from?

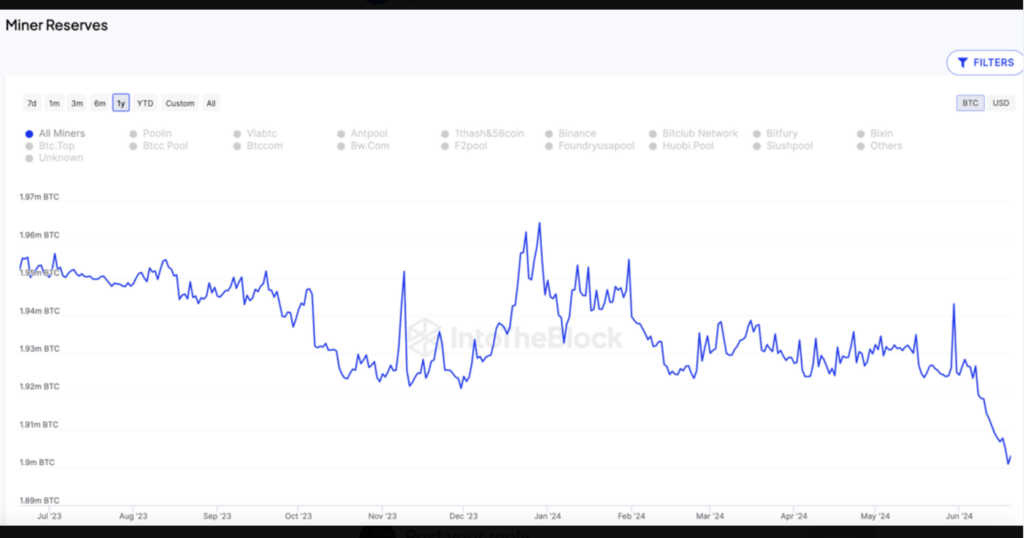

Most of the selling pressure comes from the miners: They sold over 30,000 Bitcoin in Junevalued at around $2 billion. This also happened at the fastest pace in a year. In addition, miners’ reserves have fallen to their lowest level in more than 14 years.

This sell-off is a result of lower profits after the Bitcoin halving.

Miner capitulation occurs when Bitcoin miners (particularly older models) begin to close down their operations because they are no longer profitable. This often involves selling Bitcoin to shore up balance sheets during this stressful time.

This usually occurs during:

- A bear market (if the price drops sharply —> miner income down)

- The period after the halving (because the block subsidy is halved)

Because miners are selling their stocks, there is downward pressure on the price. This leads to even lower profit margins and miners having to close down. As a result, the hashrate of the bitcoin network decreases.

Hash Ribbons

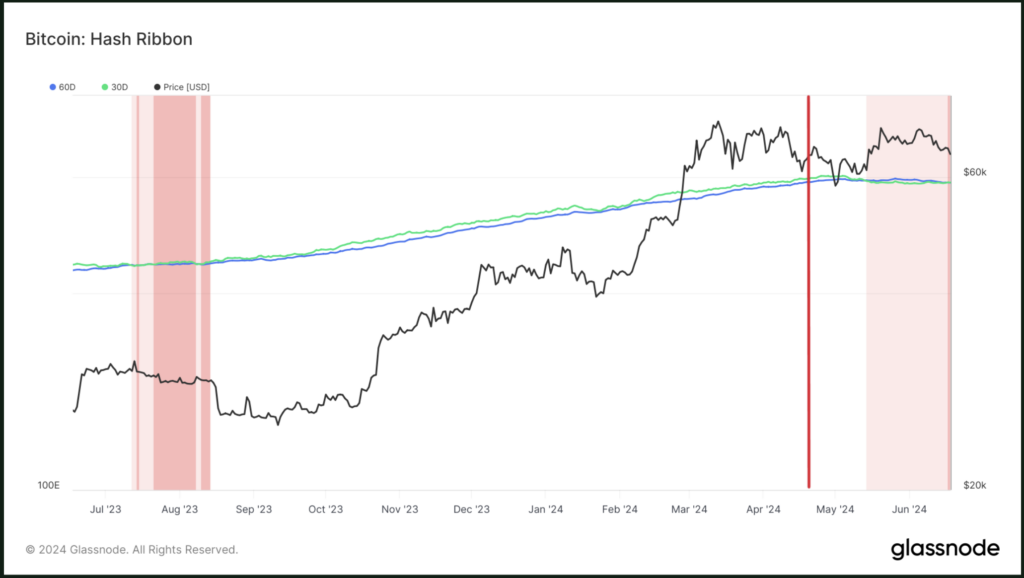

To get a more detailed picture of the capitulation of miners, look at the Hash Ribbons. When miners give up, it is possibly the most powerful buy signal for Bitcoin. The most popular hash ribbon shows us the relationship between the 30-day moving average and the 60-day moving average of the network hashrate.

When the 30-day moving average (MA) crosses below the 60-day moving average (MA), does this indicate capitulation of miners and a declining network hashrate.

If the 30-day MA rises above the 60-day MA again, this indicates that the capitulation of miners is over and that we are back on the trend of a continued increase in the network hashrate. This positive 30-60 crossing has been able to predict price developments well in the past.

Historically, the flip of the hash ribbon from negative to positive has marked a good entry point for investors and the end of a flat/negative price consolidation post-halving. This is the point when the miners’ capitulation is usually over and recovery has begun. According to the 30-60d MA hash ribbons, we emerged from the capitulation of miners on June 17.

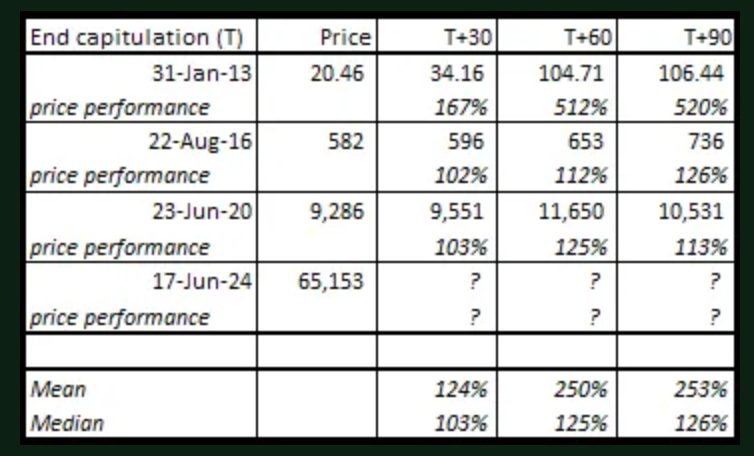

In addition, buying at these times produces incredible results. The 30-day period after the halving and after the capitulation of miners that we are now entering, has historically at least doubled the price of Bitcoin (see image below). Of course, past performance is no guarantee of future results. The market is currently processing the sell-off and we are seeing on-chain miner selling pressure wane.

Other selling parties

The German government has reportedly started selling its Bitcoin holdings. Germany has 50K Bitcoin seized and sold approximately 3K Bitcoin. Notably, the rise in Bitcoin price has resulted in an unrealized gain of $1.1 billion, increasing the value of their current holdings to $3.24 billion.

In addition, on April 2, 2K Bitcoin flowed from the seized wallets the US government. It is a relatively small and insignificant amount compared to the total sales volumes that take place every day. This week, the sale of 4K Bitcoin was added. Again, these are relatively small amounts, but there is something that stands out.

These sales are all happening around the same time period, so the timing is very interesting. Especially when you add the Mt. Gox repayments (which will start in July 2024). Fortunately, the expectation is that this will result in less selling pressure than the market thinks (see @intangiblecoins for an extensive analysis on X).

It remains to be seen how low Bitcoin can go before the market picks up again, but personally I think we have already reached the bottom.

When market sentiment points so strongly in one direction, you often see that the turnaround usually occurs ‘gradually and then suddenly’. The markets are looking ahead. The news you read today about Mt. Gox or the US and German governments are old news – the market has already priced this in.

Bitcoin expert Rick Hutting writes a weekly weekend column on the subject. You can sign up for his free daily online newsletter by clicking here . You can also follow him on Linkedin.